Empowering Relationships: BVSM Marriage Services

Explore expert advice and support for successful marriages.

Riding the Rollercoaster: How Crypto Market Volatility Keeps Investors on Their Toes

Discover the wild ride of crypto market volatility and learn how to stay ahead as an investor! Buckle up for the thrilling twists and turns!

Understanding the Basics: What Causes Crypto Market Volatility?

The crypto market is known for its significant fluctuations, which can be attributed to various factors. One of the primary causes of market volatility is the speculative nature of cryptocurrencies. Investors often buy and sell based on trends and rumors, leading to rapid price changes. Additionally, because the cryptocurrency market is less regulated than traditional financial markets, it is more susceptible to manipulative practices such as pump and dump schemes. This lack of regulation creates an environment where a single large transaction can lead to drastic price adjustments.

Another significant factor contributing to crypto market volatility is the influence of news and global events. For instance, announcements from governments regarding cryptocurrency regulations or adoption can cause immediate and pronounced reactions in pricing. Moreover, technological changes, such as updates to blockchain protocols or security breaches, impact investor confidence and market stability. Thus, understanding the various elements at play can help investors navigate the uncertainties of the crypto market, allowing for more informed decision-making amidst the volatility.

Counter-Strike is a popular tactical first-person shooter game that has captivated gamers around the world. Players can immerse themselves in intense multiplayer matches where teamwork and strategy are key to victory. For those looking to enhance their gaming experience, check out this cloudbet promo code for exciting bonuses and offers.

Surviving the Ride: Tips for Navigating Crypto Market Fluctuations

In the ever-evolving world of cryptocurrency, market fluctuations can feel like a rollercoaster ride. To successfully navigate this volatile landscape, it’s essential to adopt a strategic approach. First and foremost, research is your best friend. Stay informed about the latest trends and news that might affect prices. Utilize reputable sources, join community forums, and follow key influencers in the crypto space. Additionally, consider creating an investment plan that includes setting clear goals and understanding your risk tolerance. This proactive stance will help you manage the emotional aspect of trading, keeping panic at bay during market dips.

Another vital tip for surviving the unpredictable crypto ride is to practice diversification. By spreading your investments across various cryptocurrencies and assets, you can mitigate the impact of sudden market shifts. Incorporate a mix of established coins like Bitcoin and Ethereum alongside promising altcoins to balance your portfolio. Moreover, consider implementing stop-loss orders to protect your investments from significant losses. Regularly reviewing and adjusting your strategy can also ensure that you remain aligned with your financial goals. Remember, patience is crucial—market trends take time to stabilize, and staying disciplined can lead to long-term success.

Is Crypto Volatility Here to Stay? Analyzing Trends and Future Predictions

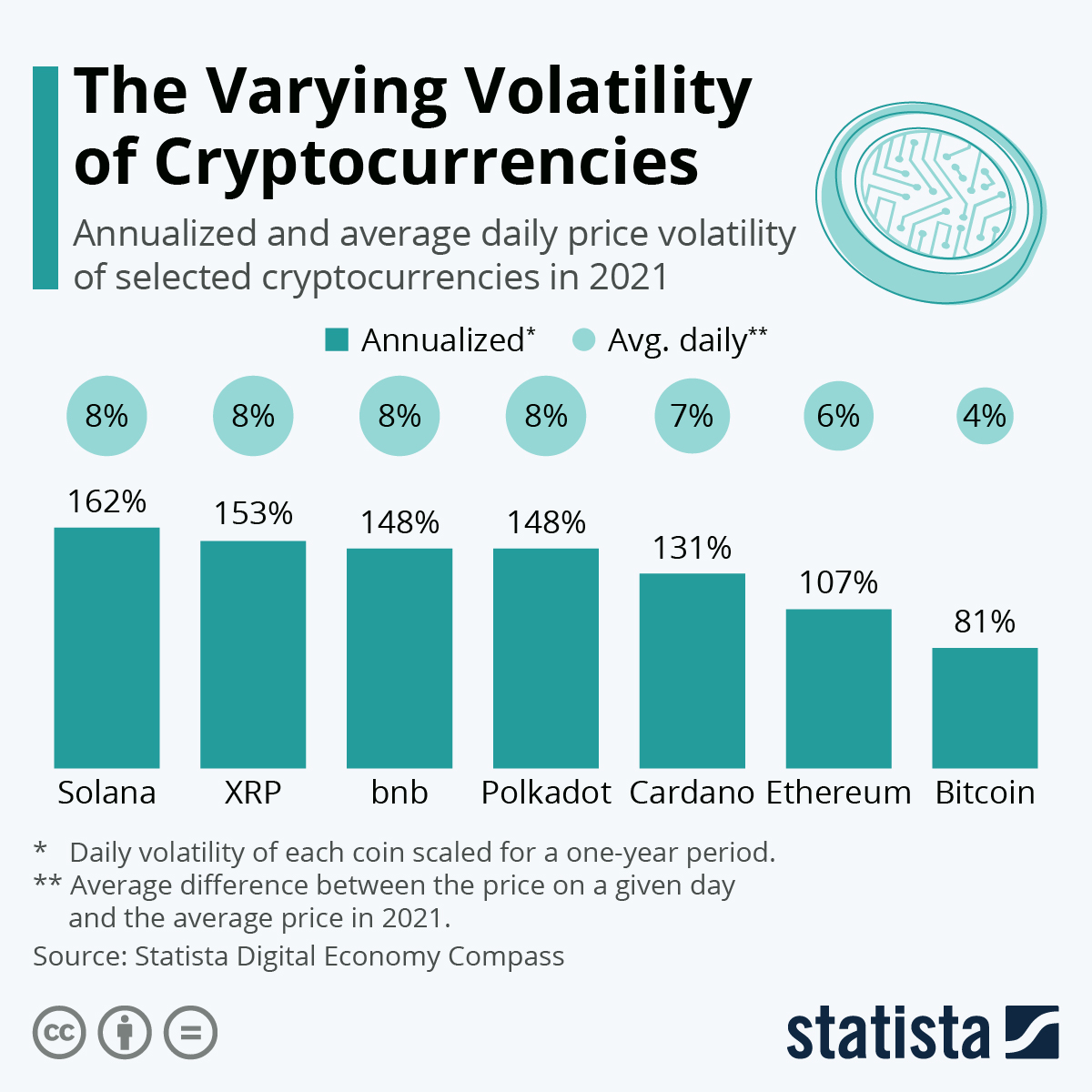

The world of cryptocurrency has been synonymous with volatility since its inception. Prices of digital currencies like Bitcoin and Ethereum can experience dramatic swings within hours, raising questions among investors and enthusiasts alike. Factors such as regulatory changes, technological advancements, and market sentiment contribute significantly to this price fluctuation. An analysis of historical trends shows that while crypto has repeatedly demonstrated periods of extreme volatility, the emergence of stablecoins and increased institutional investment may help to stabilize the market over the long term.

Looking ahead, predictions about crypto volatility suggest that it may indeed be a persistent feature of the landscape. As the market matures, we may see a decrease in the amplitude of price swings; however, the sheer number of new projects and the speculative nature of many investments keep volatility on the table. According to cryptocurrency analysts, factors like global economic conditions, investor behavior, and technological developments will play pivotal roles in shaping future trends. As such, engaging with these dynamics will be crucial for anyone looking to navigate the evolving world of digital currencies.