Empowering Relationships: BVSM Marriage Services

Explore expert advice and support for successful marriages.

When Crypto Goes Wild: Riding the Waves of Market Volatility

Dive into the thrilling world of crypto chaos! Discover how to navigate wild market swings and emerge victorious in your trading journey.

Understanding Market Volatility: Why Crypto Prices Fluctuate

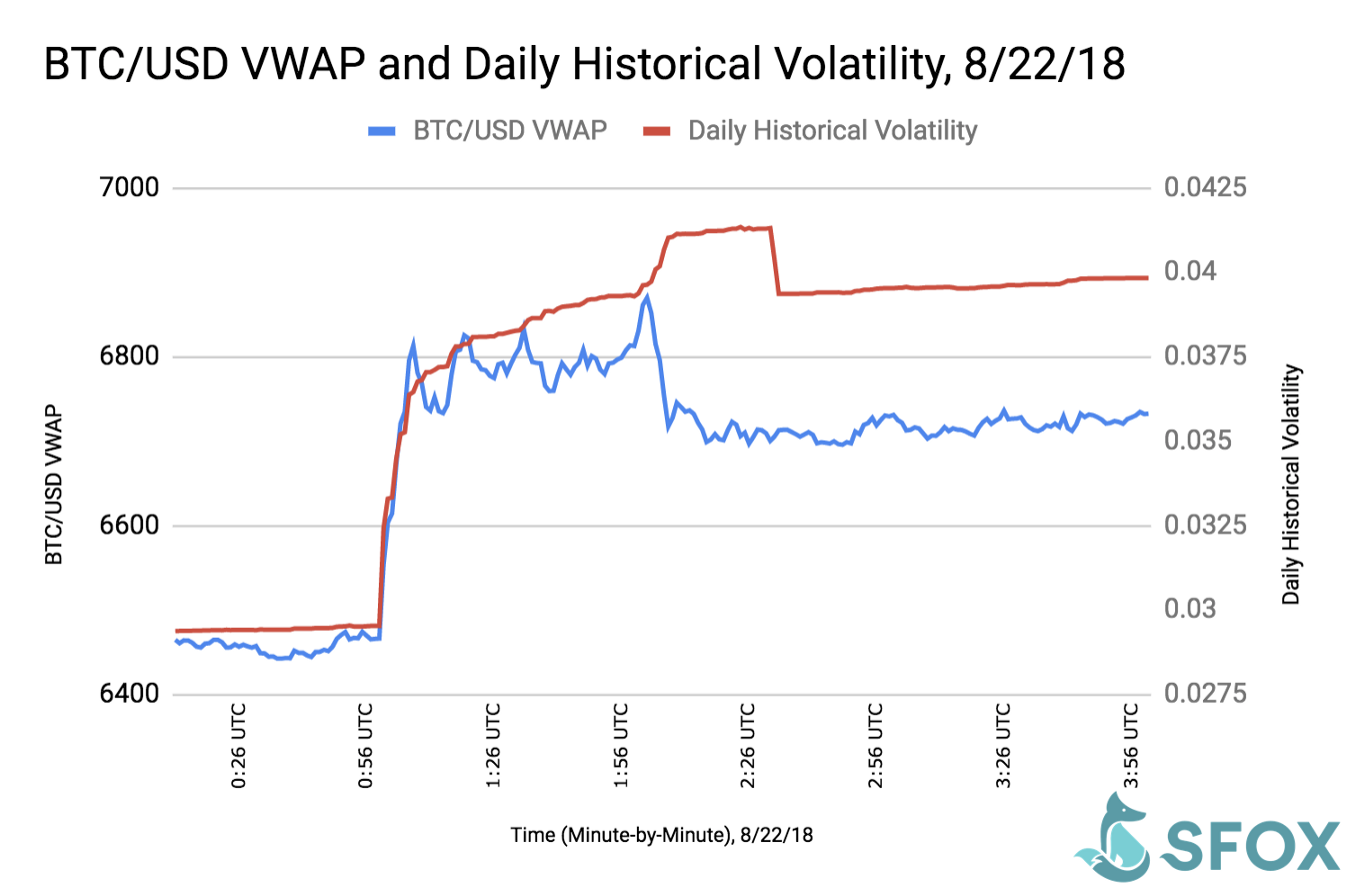

Market volatility refers to the rapid and significant price fluctuations that are common in the cryptocurrency market. Unlike traditional assets, cryptocurrencies are influenced by various factors, including market sentiment, regulatory news, technological advancements, and macroeconomic trends. For instance, a positive announcement regarding a blockchain project's partnership can lead to a surge in prices, while negative news, such as regulatory crackdowns, can result in a sharp decline. This volatility is driven by the relatively low market capitalization and the speculative nature of most cryptocurrencies, leading to more pronounced price changes with each new piece of information.

Understanding the reasons behind these price fluctuations is essential for investors and traders alike. One major factor is liquidity; in less liquid markets, even small trades can cause significant price swings. Moreover, the influence of social media cannot be underestimated, as platforms such as Twitter and Reddit often drive market trends based on public sentiment. Another important aspect is the psychological behavior of investors, where fear and greed can lead to herd behavior, further amplifying price volatility. By grasping these dynamics, investors can better navigate the unpredictable waters of the cryptocurrency market.

Counter-Strike is a multiplayer first-person shooter game that emphasizes teamwork and strategy. Players join either the terrorist or counter-terrorist team, each with unique objectives to complete. Additionally, if you're interested in gaming promotions, you can check out this cloudbet promo code to enhance your gaming experience.

Top Strategies for Navigating Crypto Market Swings

Navigating the volatile landscape of cryptocurrency requires a strategic approach to mitigate risks and capitalize on opportunities. One of the top strategies for managing market swings is to implement a diversified investment portfolio. By spreading your investments across different cryptocurrencies, you reduce the impact of a downturn in any single asset. Additionally, employing stop-loss orders can help you minimize losses during sudden price drops by automatically selling your assets at predetermined thresholds.

Another essential strategy involves staying informed about market trends and news that can influence prices. Regularly following reliable sources such as cryptocurrency news websites, forums, and expert analyses can provide critical insights into potential market movements. Additionally, utilizing technical analysis tools can help you identify patterns and make more informed decisions. Remember to maintain a level head; emotional trading often leads to poor decision-making. Instead, consider setting long-term investment goals and sticking to your plan, regardless of short-term fluctuations.

What Should Investors Do During a Crypto Crash?

During a crypto crash, it's crucial for investors to remain calm and avoid making impulsive decisions. One effective strategy is to assess your portfolio and identify which assets have long-term potential. Instead of panicking, consider holding onto strong projects with solid fundamentals. This may involve doing thorough research and analyzing market trends to understand the reasons behind the crash. Keeping a level head can help you avoid selling at a loss and position yourself for future recovery.

Another important step for investors during a crypto crash is to diversify their investments. Relying solely on one type of digital asset can be risky; therefore, consider spreading your investments across different cryptocurrencies or even traditional assets. Additionally, it's wise to stay updated with news and developments in the crypto space. Utilize resources such as official announcements, market analysis, and community discussions. By doing so, you'll be better equipped to make informed decisions and may find new opportunities emerging amidst the downturn.